Amortization Calculator

An amortization calculator helps you calculate your loan payments and generate a detailed amortization schedule showing how much of each payment goes toward principal and interest over time.

This free online tool allows you to understand your loan repayment plan clearly and make informed financial decisions.

Feel free to use our Equipment Finance Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

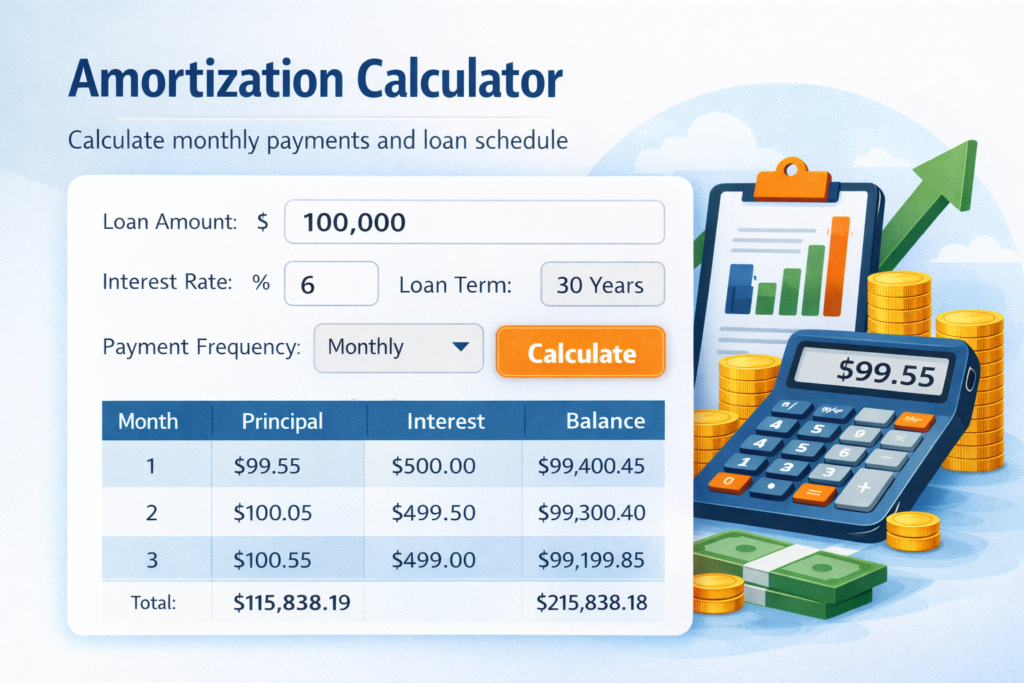

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

What Is Loan Amortization?

An amortization calculator helps you determine how a loan is repaid over time through scheduled monthly payments. It shows how much of each payment goes toward the loan principal and how much goes toward interest.

This tool allows you to:

- Estimate your monthly loan payment

- View a complete amortization schedule

- See how interest decreases over time

- Understand total interest paid

- Plan smarter financial decisions

Whether you are taking a mortgage, auto loan, or personal loan, understanding amortization helps you manage debt responsibly.

How This Amortization Calculator Works

This calculator uses standard loan amortization formulas to compute:

- Monthly payment amount

- Total interest paid

- Total payment over loan term

- Complete amortization schedule

Monthly Payment Formula:

M = P [ r(1+r)^n ] / [ (1+r)^n – 1 ]

Where:

- P = Loan principal

- r = Monthly interest rate

- n = Total number of payments

The amortization schedule shows how your loan balance decreases over time.

Example of Loan Amortization

If you borrow $100,000 at 6% interest for 30 years:

- Monthly Payment ≈ $599.55

- Total Interest Paid ≈ $115,838

- Total Payment ≈ $215,838

You can use this calculator to adjust interest rates and loan terms to compare repayment scenarios.

Let’s assume:

- Loan Amount: $200,000

- Interest Rate: 6% annually

- Loan Term: 30 years

In the first year:

- Most of your payment goes toward interest

By year 15:

- Interest portion decreases

- Principal repayment increases

Near the end of the loan:

- Almost the entire payment reduces the principal

This illustrates why understanding amortization is essential before committing to long-term debt.

Why Use an Amortization Calculator?

✔ Understand your monthly payments

✔ See total interest cost

✔ Plan early loan repayment

✔ Compare loan offers

✔ Make informed financial decisions

This tool is useful for mortgages, car loans, personal loans, and business financing.

Who Should Use This Tool?

- Home buyers

- Car buyers

- Students

- Business owners

- Financial planners

- Anyone comparing loan options

Frequently Asked Questions

What is an amortization schedule?

An amortization schedule is a table showing each loan payment, how much goes toward principal, how much goes toward interest, and the remaining balance.

Can I use this for mortgage loans?

Yes, this calculator works for mortgages, auto loans, and most installment loans.

Does this include taxes and insurance?

No. This calculator estimates loan principal and interest only.

Are results exact?

Results are based on standard financial formulas. Actual loan agreements may vary depending on lender terms and fees.

Important Disclaimer

This amortization calculator is provided for informational and educational purposes only. The results are estimates based on standard loan formulas and do not constitute financial, legal, or professional advice. Actual loan terms and payment amounts may vary. Please consult your lender or a qualified financial advisor before making financial decisions.

Usefull Links

Consumer Financial Protection Bureau (CFPB)