Payment Calculator

How a Payment Calculator Works

Most payment calculators are based on standard amortization formulas used by banks and financial institutions. They help you understand:

✔ Monthly payment you must pay

✔ Total interest over the life of the loan

✔ The impact of changing interest rates or loan term

When you enter the loan amount, interest rate, and term, this calculator instantly computes the monthly payment using a standardized mathematical formula similar to the amortization method used by lenders.

Our Mortgage Payment Calculator helps you quickly calculate monthly payments based on loan amount, interest rate, and repayment period, making financial planning easy.

Why It’s Important to Calculate Loan Payments

When borrowing money, knowing your monthly payment is essential for:

- Budgeting: Ensure payments fit within your monthly income

- Loan comparison: Compare different interest rates or terms

- Avoiding risk: Prevent overbite or financial strain

- Better planning: Estimate total interest costs before committing

Without precise payment planning, borrowers can end up paying significantly more in interest or struggle to meet monthly obligations.

Why Calculating Payments Before Borrowing Is Important

Many borrowers focus only on loan approval — not on affordability. A payment calculator helps you:

✔ Avoid financial stress

✔ Compare loan offers

✔ Understand total interest cost

✔ Choose optimal loan term

✔ Plan your monthly budget properly

Guessing loan payments can lead to over-borrowing and long-term financial strain.

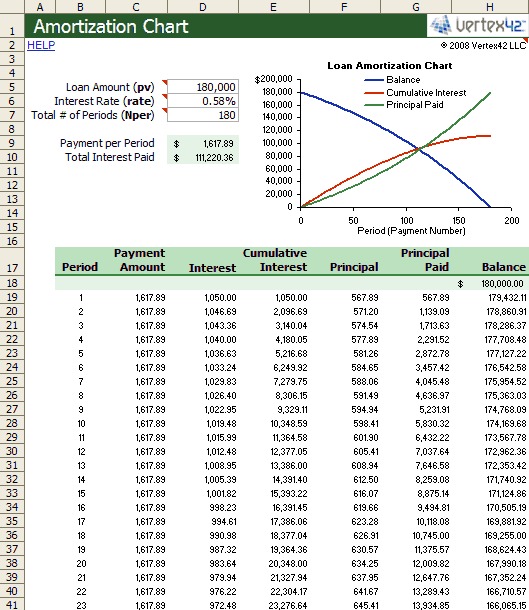

Example Loan Payment Calculation

Let’s look at a practical example:

- Loan Amount: $20,000

- Interest Rate: 6% annually

- Loan Term: 5 years

Estimated Monthly Payment: approximately $386

Over the full term, total repayment may exceed $23,000, meaning over $3,000 paid in interest.

Now compare this with:

- Same loan

- 8% interest rate

Monthly payment increases, and total interest becomes significantly higher.

This demonstrates why comparing rates and terms before borrowing is crucial.

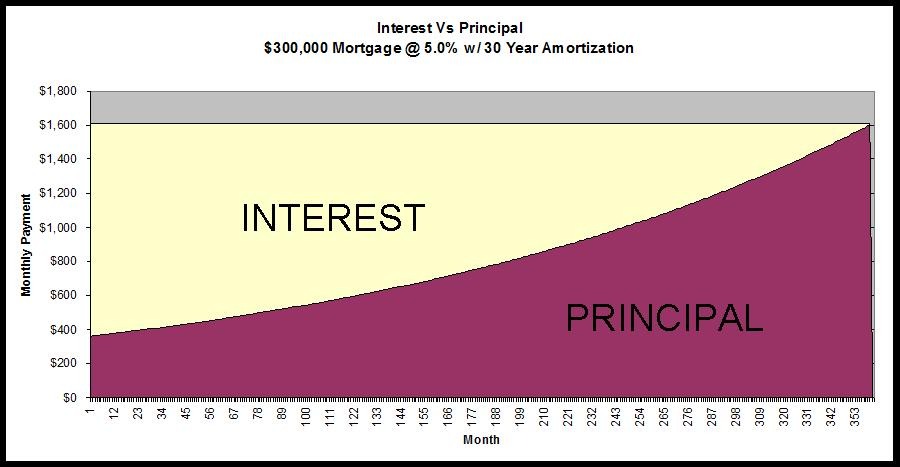

📉 Impact of Interest Rate on Monthly Payments

Even a small increase in interest rate can significantly affect total repayment.

For example:

- 5% vs 7% interest

- 5-year term

- Same loan amount

The difference may cost hundreds or thousands more over time.

Using a calculator before signing any agreement can prevent costly financial mistakes.

Internal Links

If you want to compare interest costs separately, you can also use our Interest Calculator to estimate how rates affect total repayment.

For long-term savings growth comparisons, try our Compound Interest Calculator.

If you’re planning to buy a house, our Mortgage Calculator can help estimate home loan payments more precisely.

When Should You Use a Payment Calculator?

Use this calculator when:

- Planning to take a personal loan

- Buying a vehicle

- Financing a purchase

- Comparing lenders

- Adjusting loan terms

It helps ensure your monthly payments fit comfortably within your income.

How to Reduce Monthly Loan Payments

You can lower payments by:

- Choosing a longer loan term

- Negotiating a lower interest rate

- Increasing down payment

- Improving credit score before applying

However, longer terms increase total interest paid. Always balance affordability with total cost.

Frequently Asked Questions

Is this payment calculator accurate?

It provides estimates using standard financial formulas. Actual loan payments may vary depending on lender fees, taxes, and specific terms.

Does this calculator include taxes or insurance?

No. This calculator estimates basic loan payments only. Additional charges depend on the lender.

Can I use this calculator for any type of loan?

Yes. It works for personal loans, auto loans, and general installment loans.

Is this calculator free?

Yes. All tools on Calculate4Free are completely free and require no registration.

Yes — our tools are designed to work on both desktop and mobile devices.

Payment Calculator – Estimate Your Monthly Loan Payments

Last Updated: February 16, 2026

Reviewed by: Calculate4Free Editorial Team

A Payment Calculator helps you estimate your monthly loan payments based on loan amount, interest rate, and loan term. Whether you’re planning a personal loan, auto loan, or general financing, understanding your monthly obligation is essential for smart financial planning.

Our free payment calculator provides instant estimates so you can make informed borrowing decisions.

Financial Disclaimer

The information provided by this payment calculator is for educational and informational purposes only. It does not constitute financial advice. Actual loan terms may vary depending on lender policies, credit profile, and fees. Please consult a qualified financial professional before making borrowing decisions.