Sales Tax Calculator – Calculate Total Price with Tax (2026 Guide)

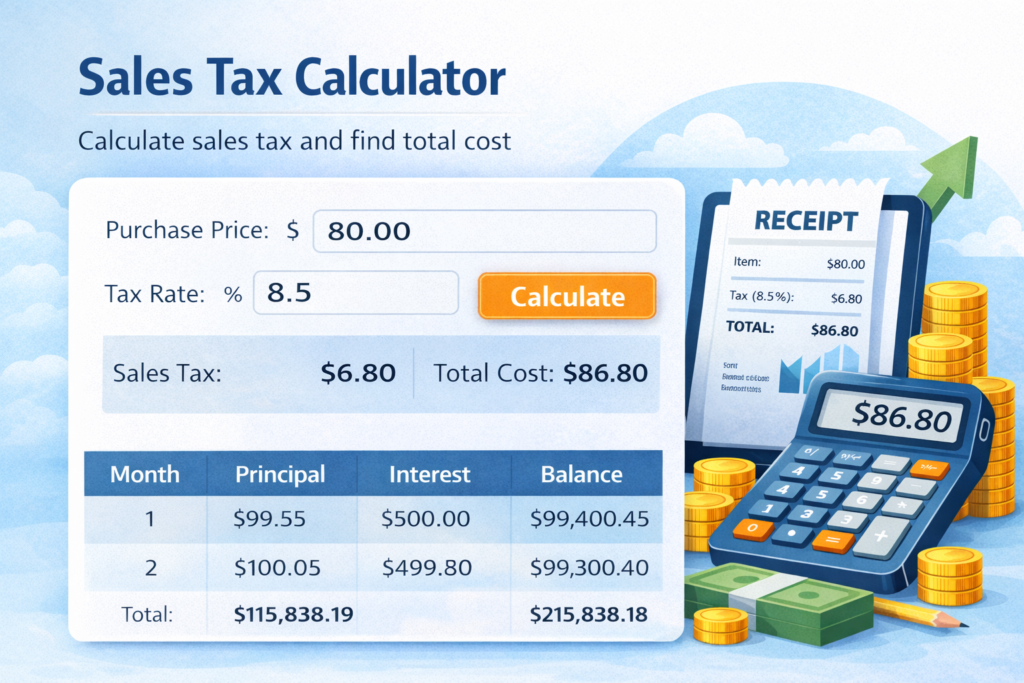

Our Sales Tax Calculator helps you quickly calculate the total price including tax. Additionally, it allows you to determine the exact tax amount based on your local rate. Whether you are shopping online or managing a business, this tool makes calculations simple and accurate. In fact, it saves time and reduces manual errors.

📊 What Is Sales Tax?

Sales tax is a consumption tax applied to goods and services at the time of purchase. In other words, it is an extra percentage added to the listed price. Generally, businesses collect this tax on behalf of the government. However, the tax rate is not the same everywhere. Instead, it varies by state, region, or country. Therefore, it is important to know your local rate before making a purchase.

For example, if your purchase amount is $100 and the sales tax rate is 8%, then your total sales tax would be $8, making the final cost $108.

Calculating sales tax is simple if you follow the correct formula. First, determine the original price of the product. Next, identify the applicable tax rate in your area. Then, multiply the price by the tax rate to find the tax amount. Finally, add the tax amount to the original price to get the total cost.

For example, if a product costs $100 and the tax rate is 8%, the tax amount will be $8. As a result, the final price becomes $108. Similarly, if the product costs $250 with a 6% tax rate, the total price will increase accordingly.

Sales tax varies depending on where you live and what you’re purchasing. It is essential to know the correct rate to accurately estimate your total cost.

How the Sales Tax Calculator Works.

Sales tax is a consumption tax

It is added to goods/services

Collected by sellers

Varies by state/country

Paid by customers at checkout

Make it simple and original.

This helps you make smart purchasing decisions and avoid surprises at checkout.

Why You Should Calculate Sales Tax

Budgeting & Planning

Understanding the total cost including tax helps you prepare your monthly budget more accurately.

Compare Prices

By calculating the tax before buying, you can compare net costs across different regions with varying tax rates.

Avoid Hidden Costs

Some price tags don’t include tax. This tool ensures you know the final amount before purchase.

Educational Insight

Learning how sales tax impacts your costs helps in financial literacy and everyday money management.

Sales Tax Formula:

Tax Amount = Price × Tax Rate

Total Price = Price + Tax Amount

Give 2–3 real examples:

Example 1:

Product price = $100

Tax rate = 8%

Tax = $8

Total = $108

Example 2:

Product price = $250

Tax rate = 6.5%

Tax = $16.25

Total = $266.25

This builds strong content value.

🧮 Practical Example

Let’s say you want to buy a laptop that costs $850 and your local sales tax rate is 7.5%:

- Sales Tax = 850 × 0.075 = $63.75

- Final Amount = 850 + 63.75 = $913.75

By using the Sales Tax Calculator, you instantly get these numbers without manual math.

🔢 When to Use a Sales Tax Calculator

You can use this tool when:

- Shopping online or in-store

- Planning monthly expenses

- Comparing prices in different states or countries

- Creating an accurate budget

- Teaching or learning basic tax math

This calculator works for any purchase amount and tax rate.

🧠 Related Financial Tools You May Find Useful

To help with broader financial planning and calculations, check out:

- Budget Calculator – Plan your monthly expenses.

https://calculate4free.com/budget-calculator/ - Payment Calculator – Estimate loan payments and total cost.

https://calculate4free.com/payment-calculator/ - Interest Calculator – Calculate interest on savings or loans.

https://calculate4free.com/interest-calculator/ - Compound Interest Calculator – Forecast long-term investment growth.

https://calculate4free.com/compound-interest-calculator/

Frequently Asked Questions (FAQ)

What is the difference between sales tax and VAT?

Sales tax is typically applied only at the point of sale and is paid by the consumer directly. VAT (Value Added Tax) is applied at each step of the production and distribution process. This calculator focuses on sales tax only.

Can this calculator handle any tax percentage?

Yes — you can enter any sales tax rate (e.g., 5%, 8.25%, or 12%) and the calculator will compute the correct amount.

Is this tool free to use?

Absolutely — all tools on Calculate4Free are completely free and do not require a login.

Does the calculator include discounts?

No — this calculator calculates sales tax on the final price you enter. If you have a discount, apply it before entering the price here.

👤 About the Author

Calculate4Free Editorial Team

The Calculate4Free Editorial Team specializes in financial tools, calculators, and educational content designed to simplify complex calculations and support financial decision-making. Our mission is to make accurate financial information accessible to everyone.

All content is reviewed periodically to maintain accuracy and relevance.

Financial Disclaimer

The results provided by this sales tax calculator are estimates for educational and informational purposes only. Actual tax amounts may vary depending on local regulations, fees, and rounding rules. Before making financial decisions, confirm the tax rate applicable in your area or consult a tax professional.