Finance Calculator — Financial Planning & Money Tools

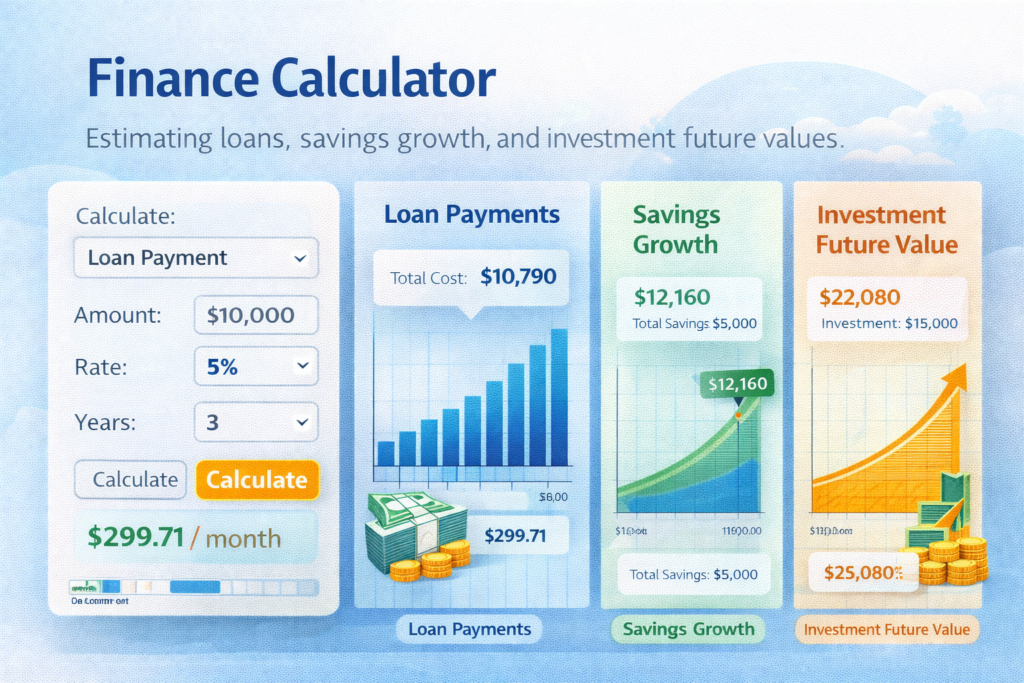

A finance calculator is a versatile financial tool designed to help you estimate, plan, and analyze your money in various situations. Whether you are calculating loan payments, savings growth, investment returns, or budgeting long-term financial goals, this calculator provides reliable estimates using standard financial formulas.

Compound Interest Calculator (USD)

Calculate the future value of your money with compound interest, supporting yearly, monthly, and daily compounding.

How This Finance Calculator Works

This finance calculator uses standard mathematical and financial formulas to compute results based on inputs you provide — such as principal amount, interest rate, time period, and payment frequency. It can help calculate:

- Monthly loan payments

- Total interest paid over time

- Future value of savings or investments

- Budget estimates for financial goals

Simply enter the relevant data into the fields, select the calculation type, and view the results instantly. Results are for informational purposes and are meant to guide your financial planning, not replace professional advice.

Common Uses of a Finance Calculator

1. Loan Planning

Estimate your monthly payments, total repayment, and interest costs for personal loans, auto loans, mortgages, and more.

2. Savings Growth

Estimate how savings grow over time based on your initial deposit, regular contributions, and interest rates.

3. Investment Evaluation

Analyze potential returns on investments with given growth assumptions and time periods.

4. Budget Forecasting

Understand how future expenses may change based on savings, inflation or planned payments.

Using a finance calculator helps you compare financial scenarios and choose options that best fit your goals.

Key Financial Concepts Explained

Interest

Interest is the cost of borrowing or the earnings from savings. It is usually expressed as a percentage of the amount over time.

Compound vs Simple Interest

- Simple Interest is calculated on the original cash amount only.

- Compound Interest includes interest earned on previously accumulated interest.

Compound interest accelerates growth over time, and this calculator includes options for both when relevant.

Practical Example

Suppose you want to save for a major purchase. You deposit $5,000 into a savings account with an annual interest rate of 4%, compounded annually, and plan to leave it untouched for 10 years.

Using this finance calculator:

- Future value ≈ $7,401

- Total interest earned ≈ $2,401

By adjusting inputs, you can test different scenarios and timeframes.

Related Financial Tools

You might also find the following calculators useful:

- Loan Calculator — Compute loan payments and amortization schedule

- Interest Calculator — Estimate simple and compound interest

- Investment Calculator — Project future investment growth

- Retirement Calculator — Plan retirement savings needs

- Mortgage Calculator — Estimate mortgage payments

Frequently Asked Questions (FAQ)

What is a finance calculator used for?

A finance calculator helps estimate financial values such as loan payments, investment growth, interest earned, and budget projections based on user inputs.

Is this finance calculator accurate?

This tool provides estimates based on standard financial formulas. Actual results can vary due to fees, changes in interest rates, and other real-world factors.

Does this calculator give financial advice?

No. This calculator is for informational purposes only and does not replace personalized financial advice from professionals.

Can this tool help with investing decisions?

Yes, this tool can estimate returns and growth scenarios, but investment decisions should also consider risk, market conditions, and professional guidance.

Useful Authority Resources

For additional information about financial planning and key concepts:

- Investopedia – Financial Basics: https://www.investopedia.com/terms/f/finance.asp

- SEC Investor Education: https://www.investor.gov/introduction-investing

- CFPB Financial Education: https://www.consumerfinance.gov/consumer-tools/financial-education/

These trusted sources provide valuable financial explanations and education.

Disclaimer

This finance calculator is provided for informational and educational purposes only. The results are estimates based on standard formulas and assumptions. They do not constitute financial, investment, or professional advice. Actual results may vary depending on your personal financial situation, market conditions, and other variables. Consult a qualified financial advisor before making significant financial decisions.