Income Tax Calculator – Estimate Your Tax Liability

An income tax calculator is an online tool that helps you estimate how much tax you owe based on your income and applicable tax rules. It makes complex tax calculations quick and easy by applying tax rates, deductions, and brackets to your taxable income.

How This Income Tax Calculator Works

This calculator applies current tax brackets and rates to your income details to estimate:

✔ Total income tax owed

✔ Net (take-home) income after tax

✔ Taxable income after standard deductions (if applicable)

You simply enter:

- Your gross annual income

- Filing status (individual, married, etc.)

- Relevant deductions (if applicable)

…and the calculator delivers an estimated tax figure instantly.

This tool uses standard formulas and publicly available tax rate information but does not replace professional tax advice or official tax filings.

Why Use an Income Tax Calculator?

Using an income tax calculator helps you:

✔ Understand your estimated tax burden before filing

✔ Plan monthly budgets based on net income

✔ Compare how different income levels affect tax liability

✔ Prepare for tax season with clearer expectations

✔ Evaluate how bonuses or extra income affect your tax bracket

Tax rules can be confusing, and manually calculating taxes is time-consuming. This calculator simplifies the process and provides quick insights.

Basic Concepts: Taxable Income, Brackets & Deductions

Taxable Income

Taxable income is the portion of your total income that is subject to tax after allowable deductions.

Tax Brackets

Most income tax systems use progressive tax brackets in which higher income is taxed at higher rates. For example:

- 10% on income up to $X

- 12% on income up to $Y

- 22% on income up to $Z

… and so on.

You can use this calculator to see how your income fits into these brackets.

Deductions

Deductions reduce your taxable income. Common deductions include:

- Standard deduction

- Retirement contributions

- Health savings accounts

- Charitable donations

Different regions or countries may have their own set of deductions, and this calculator helps visualize their impact.

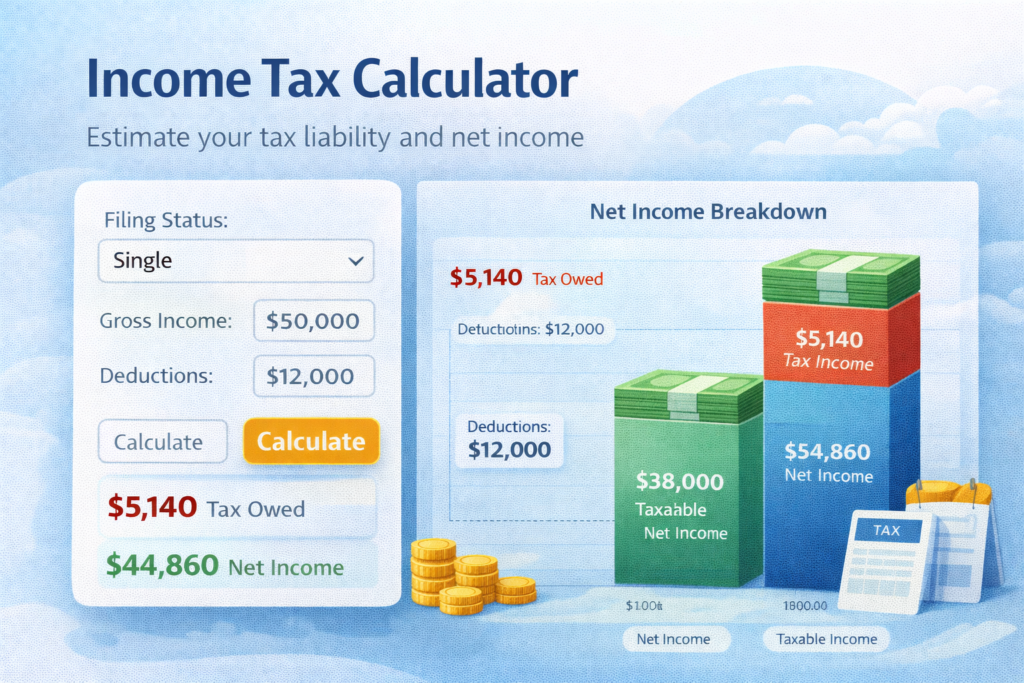

Example: Understanding Your Tax Liability

Suppose you earn $50,000 annually and claim a standard deduction of $12,000. Your taxable income would be:

$50,000 – $12,000 = $38,000

The calculator then applies the applicable tax brackets to estimate your tax owed and net income after tax.

Real tax systems can be more complex, but this example shows how deductions influence taxable income.

Related Financial Tools

You might also find these calculators useful:

- Net Income Calculator – Determine your take-home pay

- Income Tax Bracket Calculator – See which tax bracket applies

- Retirement Calculator – Plan your retirement savings

- Investment Calculator – Project investment growth

- Savings Calculator – Estimate savings over time

Internal links to these tools improve your financial planning insights.

Frequently Asked Questions (FAQ)

What tax rates does this calculator use?

This calculator uses the standard income tax brackets applicable at the time of calculation. Always verify current tax rates with official tax authority resources.

Is this calculator accurate for filing taxes?

No. This calculator provides estimates only and is not a substitute for official tax software or professional tax advice.

Does this calculator include deductions and credits?

It includes common or user-entered deductions. It does not automatically calculate itemized tax credits.

Can I use it for different countries?

This calculator generally follows U.S. or specific country tax rules depending on settings. Verify which tax system is being used before relying on the estimate.

Should I consult a tax professional?

Yes. For precise tax filing and legal compliance, always consult a qualified tax professional or certified public accountant (CPA).

Useful Resources (Authority Links)

Strengthen your page’s trust and information quality by linking to these reputable sources:

- Internal Revenue Service (IRS) – Tax Topics: https://www.irs.gov/taxtopics

- Investopedia – Income Tax Basics: https://www.investopedia.com/terms/i/income-tax.asp

- Consumer Financial Protection Bureau – Tax Filing Tips: https://www.consumerfinance.gov/consumer-tools/taxes/

These external links improve authority and support AdSense reviewer expectations.

Important Disclaimer

This income tax calculator is provided for informational and educational purposes only. The results are estimates based on general tax rules and standard formulas. They do not constitute financial, legal, or professional tax advice. Tax laws vary by country and individual situation. Always consult a qualified tax advisor or official tax authority for precise filing information and tax planning.